Open topic with navigation

Maintaining CPI Assumptions

- The CPI Assumptions screen allows the user to enter a CPI assumption percent for future years.

- It is used in relation to the Lease Charge Projection, IFRS16 Projection, Outgoings Projection and Percentage Rent Projection processes.

Menu

| File |

> |

Financial Setup |

> |

Assumptions |

> |

CPI Assumptions |

Mandatory Prerequisites

Prior to entering CPI Assumption figures, refer to the following Topics:

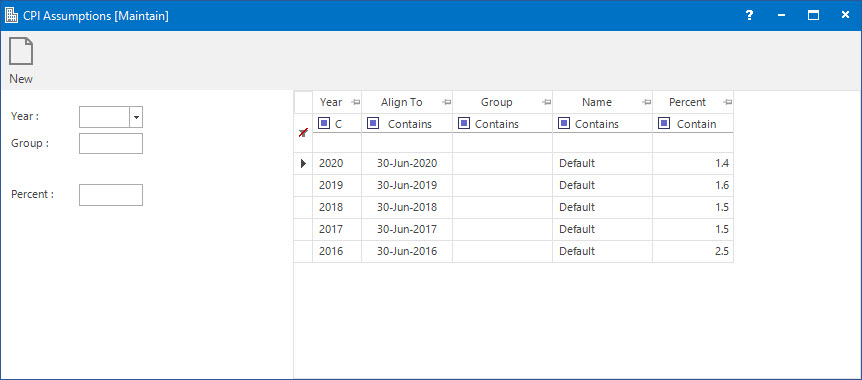

Screenshot and Field Descriptions

Year: this is the Accounting Year the CPI assumption figures will be associated with.

Year: this is the Accounting Year the CPI assumption figures will be associated with.

Group: this is the CPI Group for the CPI assumption figures. This field can be left blank to apply to all the CPI Groups.

Group: this is the CPI Group for the CPI assumption figures. This field can be left blank to apply to all the CPI Groups.

Percent: this is the CPI assumption percentage change between the current quarter and the corresponding quarter in the previous year.

Percent: this is the CPI assumption percentage change between the current quarter and the corresponding quarter in the previous year.

CPI Assumptions table: this table displays the CPI assumption figures already entered.

How Do I : Add a new CPI Assumption figure

- At the Year field, enter the accounting year associated with the CPI assumption figure.

- At the Group field, locate the group for the CPI assumption figure.

- At the Percent field, enter the assumption percentage rate for the year.

- Click the Application tool-bar push button: Add.

- Confirm that you wish to add the record.

How Do I : Modify an existing CPI Assumption figure

- Double click the row in the CPI Assumption table to change.

- At the Percent field, change the assumption percentage rate for the year.

- Click the Application tool-bar push button: Change.

- Confirm that you wish to change the record.

How Do I : Delete an existing CPI Assumption figure

- Double click the row in the CPI Assumptions table to delete.

- Click the Application tool-bar push button: Delete.

- Confirm that you wish to delete the record.

Related Topics

CPI Assumption figures are associated with the following Topics:

Year: this is the Accounting Year the CPI assumption figures will be associated with.

Group: this is the CPI Group for the CPI assumption figures. This field can be left blank to apply to all the CPI Groups.

Percent: this is the CPI assumption percentage change between the current quarter and the corresponding quarter in the previous year.